Self-Help Groups

Agriculture for small and marginal farmers requires timely and affordable credit to cover the variety of input and other costs. Rural moneylenders that dominate the informal credit market readily offer loans to the farmers with little paperwork at a rate of interest as high as 60% per annum. The inability to repay such a loan leads to the beginning of a vicious cycle where the borrowers can even become bonded labourers of the moneylender. In this scenario, a formal and timely source of credit with better terms of repayment has enabled many members to break from the shackles of intergenerational debt bondage. A savings programme enables the poor to extricate themselves from the clutches of usurious moneylenders.

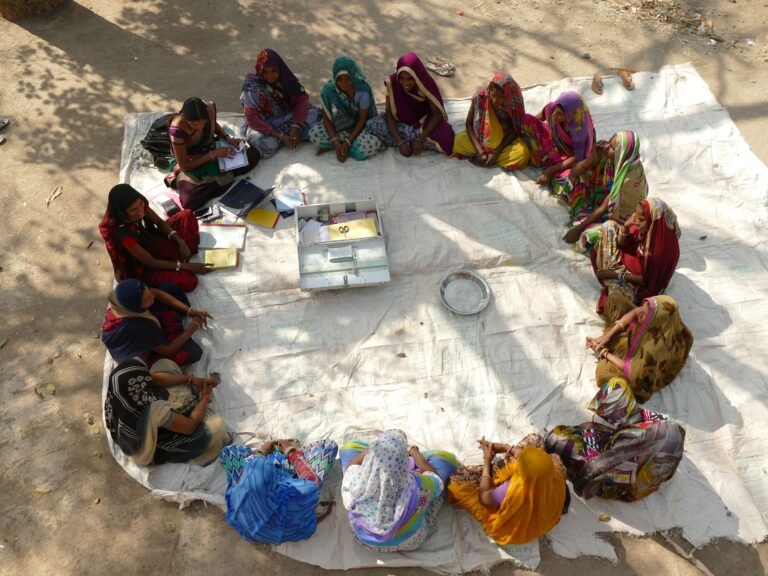

The Women’s Self-Help Group (SHG) Programme forms the bedrock of all SPS work. Most members of these SHGs belong to the marginalised- poor, Adivasis, Dalits, landless and displaced people. This programme runs in 8 blocks of Dewas and Khargone districts of Madhya Pradesh. As these disadvantaged women learn to run their own series of nested institutions – SHGs, Cluster Development Associations (of 15-20 SHGs) and Federations (of around 200 SHGs), a completely new dynamic is imparted to the development process in the area. The persistence of endemic poverty and hunger, seven decades after independence, points to the glaring lack of good governance in rural areas. These women’s federations of women’s SHGs are a key building block for effective empowerment of the poor in the tribal drylands of India, giving these regions the necessary voice in the development process. The SHG federations as community institutions are the voice of the people, working in close partnerships with the government, federations and other CSOs.

The SHG programme realises its full potential when it is tied up with livelihood programmes such as improved agriculture and allied activities, crop marketing, etc. Incomes raised through livelihood initiatives need to be saved. Of these savings, women are the best custodians. It is they who ensure that these savings are, in turn, diligently reinvested in livelihood options that raise incomes, and health and education of the family, setting up a virtuous cycle.

Our SHGs offer their members a range of financial products including regular savings, recurring deposits, fixed deposits, loans against fixed deposits, loans for emergencies (the veracity of each of which is carefully judged by the members themselves), collective purchase of basic needs of daily life, loans for cattle, well construction, cattle insurance, life insurance, etc. As of March 2020, the programme has reached 533 villages and 15 towns having formed 2,777 women’s SHGs with a total membership of 40,690 women, total member savings of Rs. 50.36 crores and total loan outstanding of Rs. 100 crores. 92% of our SHGs have been successfully linked with banks and other financial institutions. SPS has already facilitated formation of 10 SHG Federations as independent registered societies and 4 more are on their way.

The SHG programme is based on the principle of cost coverage. The programme mobilises community contributions from the members as service charges paid by SHGs to the federations. Community contributions cover about 80% of the annual recurring expenses of federations in our old SHG locations. For the programme as a whole, community contributions cover about 55% of its annual recurring expenses. With the introduction of an accounting-cum-MIS software, Pragati Mitra and the field level software, Pragati Vistaar, SHG operations are now streamlined, organised, transparent and efficient. The SHG Programme is the only one of its kind which shares CIBIL data with other financial institutions apart from using it. The unique strength of our SHG programme is financial and procedural discipline and transparency. It is mandatory for each group to go through an external audit every year, conducted by reputed chartered accountants.

SHG Films

Saath Saath Sashakt Haath

Language: Hindi and Nimari

Watch the trailer

Arzoo

Language: Hindi and Nimari

Watch the trailer